There is an unexpected short term boost in the higher end of the residential rental market going on right now, because of austere house purchase stamp duty levels and Brexit uncertainty.

A number of high end house buyers are deciding to pop into a property rental for the next year or so, using the stamp duty funds they would have allocate on a property purchase around £2.0m. or more, to pay for the property rental instead of going into the Government coffers by way of stamp duty (about £154,000 at £2.0m. and £274,000 at £3.0m.).

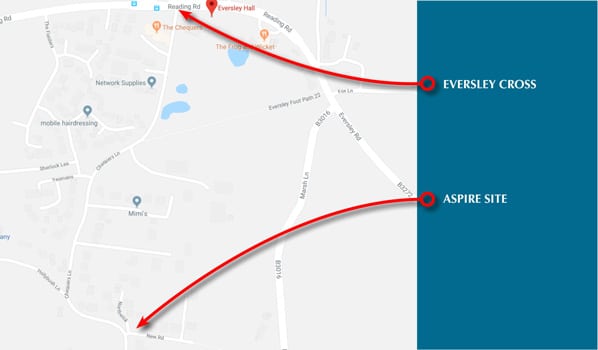

The property above has been placed on the rental market today at £6,000 p.c.m.. This is an example of a luxury house in Berkshire which will attract interest from tenants wishing to live near say Wellington College, Reading and Wokingham yet have easy access to London. The video production and photography by johnjoe.co.uk will no doubt enable a quick uptake in tenant enquiries.

The medium term outlook for top end rentals is good, and for house sales over £2.0m. there could be good new post Brexit because the level of hot buyers in rental looking to buy will be at a good level.

The market insight is that the first half of 2018 saw one of the poorest levels of house sale transactions for some time, however, right now, discerning house buyers are seeing the current market conditions as an opportunity to move whilst prices remain static. The news for house sellers is that you can and will sell successfully in today’s market, but don’t expect a fancy or inflated price.

Large house price gains are gone for a while, but like all markets when they rebound from a low they come back with a sharp and fast uptake. Savvy buyers know this and are taking care of business now.

Another example of positive movement in the rental sector £5,000 to £8,000 p.c.m. is the property shown below, which was recently snapped up by a tenant on a guide of £7,995 p.c.m. So, if you are a landlord looking for an agent to manage and rent a luxury property then go to mccarthyholden.co.uk